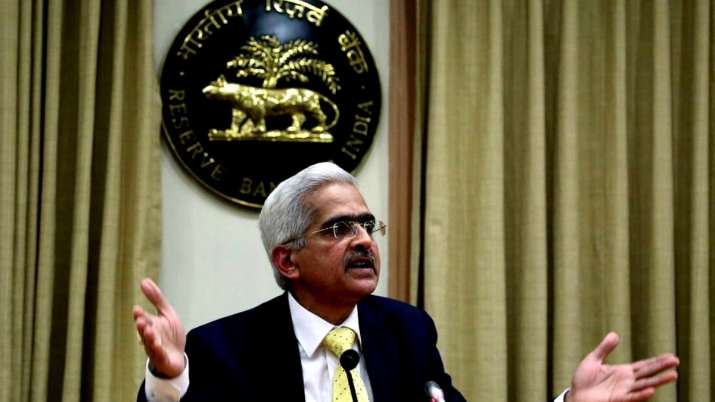

RBI Policy Repo Rate MPC Meeting Latest Updates shaktikant Das Inflation Home Loan EMI car loan.

[ad_1]

RBI Policy Repo Rate MPC Meeting Latest Updates shaktikant Das Inflation Home Loan EMI car loan.The Reserve Bank has announced the results of the three-day Monetary Policy Committee meeting. RBI Governor Shaktikanta Das announced that the interest rates have been kept steady for the second consecutive meeting. The repo rate is stable at 6.5 percent this time too. Thus, if you have taken a home loan or are going to take a car loan soon, then it is a matter of relief for you. The 43rd meeting of the six-member Monetary Policy Committee of the Reserve Bank of India (RBI) began on 6 June 2023.

Let us tell you that the Reserve Bank has been increasing the repo rate continuously since May last year. Only the MPC meeting held in April did not increase interest rates. All types of loans have become expensive due to the increase in the repo rate by the Reserve Bank. Its worst impact has been on the EMI of home loan borrowers. This is the reason why borrowers were expecting a way out from RBI. At the same time, those who invested money in the stock market were also waiting for this announcement.

Repo rate has increased by 2.5% in the last one year

RBI Policy Repo Rate MPC Meeting Latest Updates shaktikant Das Inflation Home Loan EMI car loan. Last year, amidst the rising prices of crude oil, the Reserve Bank suddenly started changing the repo rate after a break of about 2 years. Since then, in the last one year, loans in the country are continuously getting costlier. Explain that to control inflation, RBI had increased the repo rate by 2.5 percent between May 2022 and February 2023. Whose effect has been on home and car loans. Due to costlier loans, the EMI burden is also increasing. Till last year, the home loan and car loan available around 7 percent reached double digits. At the same time, everyone’s personal loan EMI (EMI) is continuously increasing. However, the common people have also benefited in the form of rising rates of fixed deposits.

What is the effect of repo rate on common man

When loans are available to banks at low interest rates i.e. repo rate is low, then they can also give cheap loans to their customers. And if the Reserve Bank increases the repo rate, it will become costlier for banks to take loans and they will make loans costlier for their customers. Explain that how the change in the repo rate affects the general public, it can be understood in simple language like this. Banks give us loans and we have to pay interest on that loan. Similarly, banks also require huge amount of money for their day-to-day operations and they take loan from Reserve Bank of India (RBI). The rate at which the Reserve Bank charges interest on this loan is called the repo rate.RBI Policy Repo Rate MPC Meeting Latest Updates shaktikant Das Inflation Home Loan EMI car loan.

How many times the interest rate increased last year

-

- May – 0.4 %

-

- June 8 -0.5 %

-

- August 5 – 0.5%

-

- September 30 – 0.5 %

-

- December 7 – 0.35 %

-

- February 8 – 0.25%

Repo Rate

Repo rate can be understood in simple language like this. Banks give us loans and we have to pay interest on that loan. Similarly, banks also require huge amount of money for their day-to-day operations and they take loan from Reserve Bank of India (RBI). The rate at which the Reserve Bank charges interest on this loan is called the repo rate.

What is the effect of repo rate on common man

When loans are available to banks at low interest rates i.e. repo rate is low, then they can also give cheap loans to their customers. And if the Reserve Bank increases the repo rate, it will become costlier for banks to take loans and they will make loans costlier for their customers.

Reverse Repo Rate

It is opposite to the repo rate. When a large amount of money is left with the banks after a day’s work, they keep that amount in the Reserve Bank. RBI gives them interest on this amount. The rate at which the Reserve Bank gives interest on this amount is called reverse repo rate.

This is how reverse repo rate affects the common man

Whenever there is too much cash in the markets, the RBI increases the reverse repo rate, so that banks deposit their money with it to earn more interest. This way, banks will be left with less money to release in the market.

Know what is Cash Reserve Ratio (CRR)

Under banking rules, every bank has to keep a certain part of its total cash reserve with the Reserve Bank, which is called Cash Reserve Ratio or Cash Reserve Ratio (CRR). These rules have been made so that if at any time a large number of depositors in any bank need to withdraw money, the bank cannot refuse to pay the money.

This is how CRR affects the common man

If the CRR increases, banks will have to keep a larger portion with the Reserve Bank and will be left with less money to lend. That means banks will have less money to give loans to the common man. If the Reserve Bank reduces the CRR, then the flow of cash in the market increases.

RBI Policy Repo Rate MPC Meeting Latest Updates shaktikant Das Inflation Home Loan EMI car loan.

[ad_2]